Month: October 2021

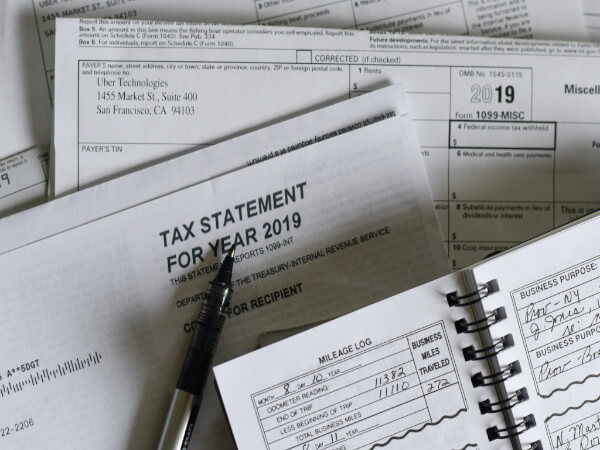

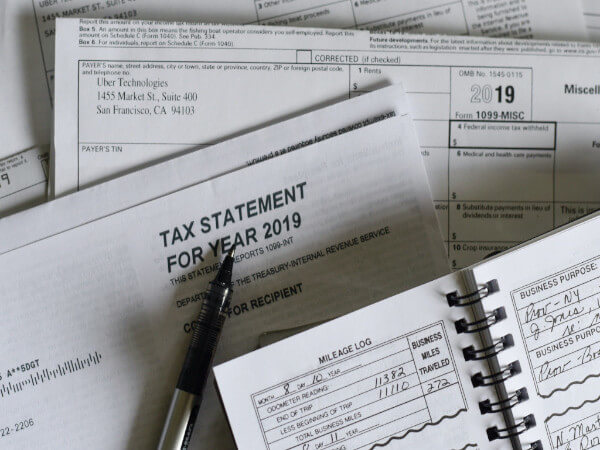

Do I Need To Pay Taxes On Private Sales Transactions?

The short answer is “yes.” In most cases, the IRS and your local tax agencies expect tax payments for gains received on larger transactions. While the details of private sales transactions may be difficult for tax agencies to track, legally you are obligated to report your capital gains on items you sell and to pay local taxes on items you purchase. Got a tax question? File confidently with legal advice from Rocket Lawyer On Call® attorneys and tax advice from our partners and friends. Get your answer Tax obligations when you sell a car If you sell a personal vehicle (car, truck, motorcycle, boat or other vehicle for personal use) for a loss, the IRS is generally not interested in the transaction. However, if you sold the car for a profit, you should report that profit as a capital gain. The gain will be classified as either “short term” or “long term,” depending on how long you owned the vehicle. An IRS Schedule D is used to report your capital gains and includes worksheets to help you determine your adjusted cost basis, so you can properly report net gains or losses. If you put a lot of permanent work into improving the vehicle, you may be able to deduct some of those costs from the gain to help reduce your tax obligation. If you sell quite a few vehicles, the IRS may have reason to believe you are in the professional car sales business. Of course, if you are in the car sales business, you’ll want to report your income taxes, capital gains taxes, and business taxes appropriately to avoid issues with the IRS. Tax obligation when you buy a car through a private sale When you purchase a vehicle through a private sale, you must pay the associated local

Read MoreHow Should Employers Respond to Workplace Injuries?

Serious workplace injuries happen every day across America. No employer wants to see employees injured while doing their jobs. Unfortunately, accidents happen no matter how much you try to avoid them, but if you are prepared, you will know what to do. Understanding workplace injuries, taking preventative measures to avoid them, and developing a plan of action in response to an injury are all “must-dos” for good employers. Need to make a Work Injury Report? Properly record what happened in a simple interview form. We make it affordable and simple. Get started now What are the most common workplace injuries? The most common workplace injuries are some of the most preventable. Careful planning can help workers avoid injuries that can affect them for the rest of their lives. 1. Slips, trips, and falls Falls make up roughly one-third of all injuries in the workplace. They are the number one cause of workers’ compensation cases across the United States. Although a trip or slip may seem minor, they can result in serious head or neck injuries, broken bones, or a lot of other health problems. 2. Working with machinery A machinery accident is not unusual in a factory, construction, or farm setting, but it can happen any place where workers engage with heavy machinery. Getting your body caught in moving equipment can result in long-term debilitation. 3. Vehicle-related accidents Car accidents happen every day. Some are the result of employees spending time on the road for work-related reasons. Other injuries occur when workers are struck by moving vehicles in a work setting, such as in a warehouse or shipping/receiving area. 4. Fires and explosions Fires and explosions do not happen often, but when employees work with combustible materials, those workplace accidents can be severe—affecting multiple workers at one time. Burns and

Read MoreKeep Renters From Burning Down Your Property on the 4th of July

Independence Day celebrations are almost here, and with them comes the risk of accidents and fires. While most people take precautions, landlords have an additional worry when it comes to their tenants. Here are some property management techniques that can help prevent or reduce property damage and personal injuries caused by fireworks and fire on the 4th of July. Lease Confidently with Rocket Lawyer Get all the legal help you need to manage your property. Anytime. Anywhere. Get started now Can you stop renters from setting off fireworks on your property? There are two ways to potentially stop renters from shooting off 4th of July fireworks on your property. One is through your lease and the other involves local laws. Your lease may have a list of rules or it may refer to a separate list of rules, like zoning or homeowners association bylaws. For example, a lease at a multifamily home may refer to separate community rules for things like pool hours. Your lease or the rules themselves may give you the authority to modify these rules at any time. This is useful because a fireworks clause is not a common lease term. If your lease enables you to make rules, you can notify your tenants in advance of the holiday that fireworks are not allowed on the property. Many local laws and ordinances also prohibit fireworks. A reminder is enough to stop many tenants from using fireworks. If your tenants break these laws, especially if it disturbs other people or causes property damage, you may have the right to evict for illegal activity. You can use the Rocket Lawyer Eviction Process Worksheet to determine whether you can evict and what steps you can take. Keep in mind that local laws will vary on whether setting off fireworks is

Read MoreHow To Pay Employees for 4th of July

While we all may agree that the Fourth of July is a joyous time of year, for small business employers, it can also be confusing. After all, the Fourth of July is a federal holiday, and employers and employees often wonder whether holiday pay, time and a half, or maybe even double time pay is required. Below, you’ll learn about how to pay employees on the 4th of July. Need pay and benefits documents for your employees? Put your compensation and time off policies in writing. We make it affordable and simple. Get started now How does holiday pay work for Independence Day? There is no federal law requiring private employers or small businesses to pay employees time and a half on Independence Day, and that’s true for any other holiday. Federal, state, and local government employees are usually provided time off or paid overtime for work on the Fourth of July. So that means how holiday pay works will depend on state labor laws and an employer’s policies. Most businesses only have to provide holiday pay or time off if they have a policy or common practice of paying overtime or providing paid time off on holidays. When it comes to state laws, there are only two states that require holiday pay, and both include Independence Day in their list of holidays: Massachusetts and Rhode Island. For more information about these state’s holiday pay rules, ask a lawyer or visit the labor department website for each state: MassachusettsRhode Island re workers paid time and a half or double time for overtime on the Fourth of July? Outside of government employment, and Massachusetts and Rhode Island, unless an employer has affirmatively agreed to pay overtime or double time for all hours worked on holidays, then this is entirely up to

Read MoreShould I Sign a Prenuptial Agreement?

Many people believe a Prenuptial Agreement, or prenup, is a bad idea because it implies they are planning on a divorce at the same time they’re planning a wedding. But the truth is, a Prenuptial Agreement protects both spouses financially in case of divorce, disability, or death. Here, we answer some common questions about Prenuptial Agreements. Want to make a Prenuptial Agreement? Prepare a financial agreement that covers assets, debts, and children. We make it affordable and simple. Get started now Should I sign a Prenuptial Agreement? Being financially responsible is important for everyone. A Prenuptial Agreement can help protect each party’s current assets and ensure both spouses remain responsible for the debt they brought into the relationship. If either partner has children from a prior relationship, a Prenuptial Agreement can help ensure their financial stability as well. Prenuptial Agreements protect both partners, and they are helpful in the event a marriage does end in divorce. And it’s far easier to negotiate a financial arrangement that works for both parties while you’re communicating well, rather than waiting until your relationship becomes contentious. What happens if I don’t sign a prenup? State law prevails when there is no Prenuptial Agreement. For couples who live in states that adhere to community property laws, this means that most assets or liabilities accumulated during the marriage would be divided equally between the parties. However, individuals are able to retain assets they brought into the marriage and kept separate. In states that don’t follow community property principles, distribution of assets normally follows a process called “equitable distribution.” In these states, multiple factors are taken into consideration to ensure property is distributed in a fair way between divorcing parties. Either way, it is helpful to have a Prenuptial Agreement ahead of time that allows you to

Read MoreFive Ways to Reduce Lawyer Burnout and Improve Employee Retention

Last week I served on a panel about attorney burnout for a bar association club for attorneys in their first 10 years of practice. The panelists had lots of helpful guidance and information to share. The last question asked by an attendee, however, perfectly exemplified the real problem with burnout, and the way I answered repeated the same problem pattern. Here’s what I mean. sking the Right Questions About Attorney Burnout The question was about how to handle unreasonable expectations from a supervising attorney. In the example, based on the lawyer’s real-world experience, the partner would promise a deliverable to his client without consulting his team and then delay delegating the task to the more junior attorneys. The partner would then have an unrealistic deadline and freak out because he had promised the client an answer or deliverable by a date that was, by that time, impossible. The associate asked the panel: What should I do? How should I handle it? We provided good techniques for communicating the impossibility of the task to her supervising attorney, and how to talk with others about possibly getting an extension for others’ work without pressing deadlines. We also discussed how she could communicate the specifics of what she would be able to produce in the timeframe provided. This was all useful information, and hopefully, it helped the associate. But thinking about the question later, I realized we had addressed the wrong question. Whose Problem Are We Solving? Sure, we answered the question asked, but really, the question was about how to avoid getting in that situation in the first place. More importantly, the answers should have focused on the fact that the associate should not be the one responsible for solving this problem. There is plenty of advice out there about being proactive

Read MoreSC on accepting and discarding the testimony of witnesses

The Supreme Court made an observation that merely on the ground that Test Identification Parade, i.e. TIP, had not been conducted, the testimony of a witness who identified the accused in the court could not be discarded. In the instant case, the prosecution witness confessed that he had been unable to identify any individual whom he had seen 11 years ago, however, he asserted that he would be able to identify the accused even though he has seen him for the first time 11 years ago, on the day of incident. The division bench stated that usually there is presence of sufficient corroborative evidence to corroborate the testimony of witnesses. The bench allowed the appeal filed by the accused who had been convicted under Section 55(a) of Kerala Akbari Act, and disbelieved the witness who had identified the accused in the court on the ground that he had seen him for the first time in 11 years. The accused contended that since the TIP had not been conducted, the prosecution’s version could not be relied upon. The bench, however, clarified that the TIP is a part of investigation and does not form part of substantive evidence. The post SC on accepting and discarding the testimony of witnesses appeared first on LexForti . Randy Reidwww.itcse.org

Read MoreRelaxation of Validation (Section 119 of the Finance Act, 2012) Rules, 2021

Centre notifies new Rules [Relaxation of Validation (Section 119 of the Finance Act, 2012) Rules, 2021; to settle the controversial retrospective tax case concerning Vodafone. INTRODUCTION Last year, Vodafone won an arbitration case against the Indian Government of amount worth Rs. 20,000 crores. There was this company Hutch. Vodafone in 2007 bought Hutch. There is a particular tax levied on the capital gain. Vodafone bought Hutch. Hutch got capital gain. Here Vodafone made payment to Hutch. Legally, Vodafone if is making payment to Hutch; Vodafone will have to hold its capital gain and pay rest to Hutch. Now here the capital gain tax; which was supposed to be paid to Government was Rs. 22,100 Crore; which was not put on hold. This matter went to the Permanent Court of Arbitration. It held that the taxation put here is wrongful; as there was breach of the guarantee of fair and equitable treatment to the Vodafone. Background In May 2007, Vodafone had bought a 67% stake in Hutch for 11 billion dollars. Here Hutch is gaining capital gain. Here instead of Hutch; Vodafone is supposed to pay the tax. Vodafone contended that, Income Tax Act has no such provisions; and we are not liable to make the payment. Vodafone went to Bombay High Court; however, Bombay High Court ruled in the favour of Income Tax Department. Vodafone challenged it in the Supreme Court. Supreme Court overruled it and held that Vodafone Group’s interpretation of IT Act, is correct. This ruling was passed in the year 2012. The then finance minister, Pranab Mukherjee, circumvented the Supreme Court’s ruling. As Government was unhappy with the decision, it decided to amend the Finance Act retrospectively. There was global backlash upon this decision. After much criticism, Government decided to proceed to amicably settle the dispute. It

Read MoreRevfin Services Private Limited Raises Pre-Series A Investment

Ahlawat & Associates’ transactional team has advised Revfin Services Private Limited, a start-up electric vehicles-focused financing company operating a digital lending platform providing financial assistance by partnering with various financial institutions on its Pre-Series A Investment round which was led by LetsVenture Angel Fund along with existing angel investors. The Delhi-based business platform focuses on consumer lending enabling financing of electric three-wheeler loans in Tier 3 and Tier 4 towns. The target consumer of the business is largely away from the traditionally focused hotspots such as Maharashtra, Karnataka, Hyderabad, and other states. The deal marks A&A’s latest advisory in relation to the investment raised by Revfin Services Private Limited. Partner, Uday Singh Ahlawat led the deal from Ahlawat & Associates’ team with support from Senior Associate, Disha Toshniwal, and Associate, Sarthak Chawla. “The promising sector of Finance technology (fintech) is growing at a rapid pace and there is a huge capital chasing a smaller number of start-ups engaged in this sector” Disha Toshniwal, (Senior Associate) Ahlawat & Associates The post Revfin Services Private Limited Raises Pre-Series A Investment appeared first on LexForti . Did you miss our previous article… https://www.itcse.org/?p=253 Randy Reidwww.itcse.org

Read MoreAn absconder, against whom proceedings have been initiated, not entitled to anticipatory bail- SC

The Apex Court, while setting aside the order of High Court, made an observation that an absconder or a proclaimed offender, against whom proceedings have been initiated, is not entitled to a relief of anticipatory bail. The procedural history of this case has its traces in Trial Court’s order which dismissed the anticipatory bail application on similar grounds. The trial court denied the anticipatory bail to accused as proceedings under Sections 82 and 83 of the Code of Criminal Procedure, 1973 had already been issued. Thereafter, the accused approached the High Court which allowed the application. Aggrieved by the order of High Court, the state approached the apex court and placed reliance on the verdict of State of Madhya Pradesh v Pradeep Sharma. The counsel contended that the person, against whom proclamation has been issued and the proceedings under above mentioned sections have been initiated, does not stand entitled to the benefit of relief under anticipatory bail. The court accepted the contention of the counsel and noted that the High Court missed out on the facts which stated that the proceedings had already begun under Sections 82 and 83 of CrPC. The court allowed the appeal and observed that what matters the most is the nature of allegations and accusations, and not that the nature of accusation arising out of a business transaction. The post An absconder, against whom proceedings have been initiated, not entitled to anticipatory bail- SC appeared first on LexForti . Did you miss our previous article… https://www.itcse.org/?p=250 Randy Reidwww.itcse.org

Read More