Day: December 4, 2021

Checklist for Conducting Your Law Firm’s Year-End Financial Review

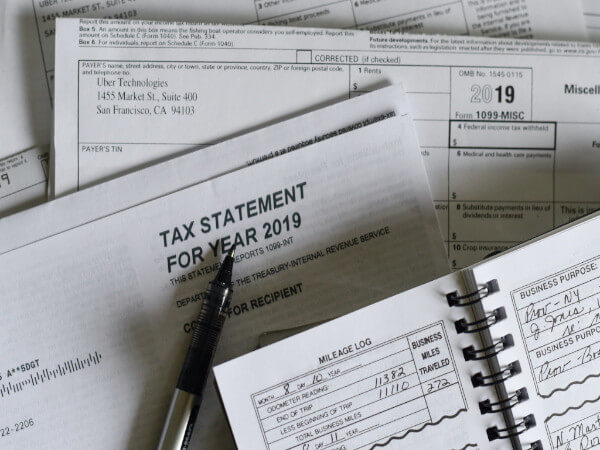

The end of the year is barreling toward us — are you ready? If not, here are a few tips for tidying up your practice and doing a comprehensive financial review. Financial Management for Your Firm For many lawyers, financial management is the business area of practicing law that provides the most heartburn. It’s completely understandable. But it is to your detriment when you don’t understand the financial fundamentals better. Hire financial advisors to aid you in better understanding your business. Too many lawyers delegate responsibility to employees who have not been properly trained. Be aware of potential landmines. A major red flag is having one employee who has all financial responsibility: check writing, bookkeeping, trust accounting and reconciliation, as well as maintaining all communication with your financial partners and bank. Checks and balances are key. Often, there is no ill intent on the part of the employee, just a lack of knowledge. If, as the owner, you do not understand the process, you will have a hard time finding the flaws in your system or properly supervising. nalyze your cash flow. Brenda Barnes, owner of B2 Management & Consulting, has this to say about law firm finance: “A good system of cash flow management can spell the difference between a successful business and a failed one. You need positive future cash flow to meet your debt commitments. Strong cash flow management also provides the ability to invest in growth. Getting to a position of excess cash flow helps your company operate in a strategic, proactive way, and can help keep you from operating on the defensive. Year-end is an excellent time to document your cash flow, prepare a cash flow budget, and look for areas of improvement.” What Should a Law Firm Financial Review Include? A Year-End Checklist Barnes

Read More