Category: Business Tips

Employee who conceals facts, makes false declarations, not entitled continue service as a matter of right- SC

The Apex Court, while allowing the appeal, made an observation that an employee who made false declarations or suppressed material facts, like his involvement in a criminal case, should not be entitled to continue in service or be appointed as a matter of right. In the instant case, the employee had been employed by the Rajasthan Rajya Vidyut Prasaran Nigam Limited. At the time of employment, he had submitted a declaration during document verification wherein he admitted that neither any criminal case had been pending against him, nor had he been convicted by any court of law in a criminal case. Later, upon scrutiny, it had been found that he had been convicted in a criminal case and consequently had been terminated. Aggrieved by the termination order, the employee approached the High Court and challenged the order. The High Court relied upon the verdict given in the Avtar Singh Case [(2016) 8 SCC 471], quashed the termination order, and directed the reinstatement of employee along with consequential benefits. Thereafter, the employer approached the apex court where the employee-respondent contended that he had been extended the benefit provided under Section 12 of the Act, 1958 wherein a person is immune from disqualification owing to his conviction. The bench rejected the contention on the ground that the immunity could not be enjoyed in cases of false declaration which had been made by the employee-respondent. The bench further explained that even in case of acquittal, the person could not claim an appointment, as a matter of right, which he lost due to false declaration or concealment of facts. Moreover, it had been observed that the issue did not involve question of employee’s involvement in a dispute or whether he had been acquitted, rather, it revolves around the creditworthiness/credibility of employee. The employee by

Read MoreAG grants consent to initiate criminal contempt proceedings against Ajeet Bharti

The Attorney General for India, KK Venugopal, through a letter granted sanction to initiate criminal contempt proceedings against Ajeet Bharti, for the derogatory words used against the Supreme Court and its esteem judges, in a YouTube video which released on June 24, 2021. He further used the terms “scurrilous”, “vituperative”, and “highly derogatory” to remark the contents of the video. The video, which intended to denigrate the reputation of judiciary and raised allegations of abuse of power, bribery and favoritism, had been viewed by almost 1.7 lakh persons. The consent had been granted in furtherance of a letter written to the Attorney General to sought for his consent to initiate criminal contempt proceedings under Section 15 of Contempt of Courts Act, 1971 r/w Rule 3(c) of the Rules to Regulate Proceedings for Contempt of the Supreme Court, 1975. The Attorney General expressed its concern towards the image of Indian judiciary and stated that regardless of individual’s motive, he had been educated enough to know the consequences of his actions. The statements and remarks so made were sufficient enough to lower the image of judiciary in the eyes of general public. Throughout the video, previously settled precedents by the Supreme Court had been mocked at, stating that many of the high-profile cases had been shut down at the instance of other authorities and the judges were referred to as “sinners.” The post AG grants consent to initiate criminal contempt proceedings against Ajeet Bharti appeared first on LexForti Legal News & Journal. Randy Reidwww.itcse.org

Read MoreSC on COVID-19 casualties and difficulties faced by the family members

The Apex Court expressed its concern regarding the difficulties which the family members of deceased COVID-19 patients have to face while obtaining the required medical certificates. The bench further referred to an instance from the second wave and remarked that back then the hospitals were in a hurry to dispose of the bodies without providing any certificates and were behaving like monarchs. The bench expressed its concerns with the Central Government while hearing an application which sought for compliance of directions which had been issued by the instant court in the month of June. In the respective order, the apex court had issued directions regarding compensation for COVID-19 deaths and for simplifying the procedure laid down for the collection of death certificates, in COVID cases. In response to this, the Solicitor General had submitted an affidavit on behalf of the Union, wherein it stated that those COVID-19 cases which had not been resolved and the patient had passed away either under hospital settings or at home, and a MCCD had issued to the registering authority in a specific format, would be considered as a death due to COVID-19. The particulars regarding the Medical Certificate of Cause of Death (MCCD) had been mentioned under Section 10 of Registration of Birth and Death, 1969. The Solicitor General clarified the stand of the Union and submitted that the Centre has taken measures in order to extend benefits to maximum possible citizens who’ve lost their family members due to the COVID-19. The post SC on COVID-19 casualties and difficulties faced by the family members appeared first on LexForti Legal News & Journal. Did you miss our previous article… https://www.itcse.org/?p=346 Randy Reidwww.itcse.org

Read MoreMinority no ground to deny permission for organ donation- Delhi HC

The Delhi High Court, with respect to an organ donation case, made an oral observation that a person could not be declared as “ineligible” for donating organs merely on the ground that he/she is a minor. In the instant case, the petitioner filed a petition to challenge the order of Deputy Head of Operations, Institute of Liver & Biliary Sciences (ILBS) that denied permission to 17-year-old petitioner from donating a part of his liver on account of him being a minor. The counsel on behalf of petitioner averred that the other two eligible individuals, petitioner’s mother and elder mother, had been denied permission on ground of medical reasons. Based on this reason, the petitioner sought for appropriate directions from Delhi Government and ILBS but the same had been denied. The bench referred to governing provision under Transplantation of Human Organs & Tissues Rules, 2014, Rule 5(3)(g) which does not authorize transplantation of living tissues and organs by a minor except under exceptional medical grounds. Relying on the above provision, the bench observed that in the instant case, exceptional medical grounds had been present and yet the authorities had passed an unreasoned order. The bench further remarked that the act of authorities has not been in furtherance of saving a life. It suggested that the application could’ve been rejected if the eligibility had not been met, but outright bar, which is not even mentioned in the statute, could not be imposed on petitioner. Subsequently, the counsel on behalf of respondent pointed out the importance of minor’s life and pleaded before the bench to let the competent authority take a call after ascertaining that the donation would not cause any harm to the minor. The bench has adjourned the matter and directed the respondent to obtain instructions for the purpose of further

Read MoreEssay Writing Competition hosted by Centre for Advanced Studies in Criminal Law, at Rajiv Gandhi National University of Law (RGNUL), Punjab

bout the Centre For Advanced Studies In Criminal Law RGNUL has established the Centre for Advanced Studies in Criminal Law (CASCL) to undertake: advanced study and research in the emerging areas of criminal law; professional training including sensitization on application and enforcement of criminal law in the fair and coherent manner; research projects independently or in collaboration with professional organisations at the national and international level; to bring about publications and produce study material on various aspects of criminal law and to organize seminars, workshops and conferences on contemporary and significant issues of criminal law. bout the Competition CASCL brings to students its Essay Writing Competition in order to provide writers a platform to test their adroitness for writing and an opportunity to explore a wide range of challenging and interesting questions beyond the college curriculum. The objective of the competition is to encourage students to inculcate an interest for studies in criminal law along with a passion for writing. Theme Exploring Gender Justice: The Laws and the Lacunae Eligibility The competition is open to students enrolled in UG Or PG courses from any recognised university. Prizes 1st Prize: ₹10, 000 2nd Prize: ₹7, 000 3rd Prize: ₹5, 000 E-Certificates shall be awarded to top 10 entries E -Certificate of Participation shall be awarded to all the participants. Registration Registration is free of cost. Link to register: https://docs.google.com/forms/d/e/1FAIpQLSe3173gACb5JJ2fExVfwpPFqiOIzrnPky9P53cdYgbkgycUaA/viewform Deadline Deadline for submission and registration is 10th November 2021, 11:59pm. Please go through the Brochure for more details. For any further queries, contact- Tanya Mayal- +91 8196019150 (Convenor, CASCL) Rishav Devrani- +91 7895191377 (Convenor, CASCL) Poster for the Event The post Essay Writing Competition hosted by Centre for Advanced Studies in Criminal Law, at Rajiv Gandhi National University of Law (RGNUL), Punjab appeared first on LexForti Legal News & Journal. Did you

Read MoreRight vested under Art. 14 violated when equals treated unequally- SC

The Apex Court, while allowing an appeal, made an observation that Right to Equality enshrined under Article 14 of the Constitution of India is a vested right and it appears to be violated when equals are treated unequally. According to the appellant, the State government had accepted the proposal of KUDA to allot 200 sq. yard developed plot free of cost to each of the 134 ex-employees of a mill in the form of a rehabilitation and welfare measure. Knowing this, the 318 other retired workers who had opted for voluntary retirement along with the previous 134 workers made a representation before the government for allotting them the plot. However, the government rejected their request. Aggrieved by this, the workers’ approached High Court. The single-bench High Court had allowed the writ petition, but upon appeal, the Division bench had set aside the judgment. The appellants’ then approached the apex court wherein they contended that there stands no reasonable differentia between the 134 ex-employees who had taken voluntary retirement and remaining 318 who had also taken up the benefit of voluntary retirement. The bench accepted the contentions made by appellant and stated that for a classification to be valid, they must stand two tests- the distinguishing rationale should be based on a just objective and the choice of differentiating two sets of persons ought to bear a reasonable nexus to the objects sought to be achieved. The bench further observed that there had been no justification for treating 318 ex-employees different from the 134 ex-employees. Therefore, the bench restored the single bench judgment and directed the state government to allot plots to the remaining 318 ex-employees as well. The post Right vested under Art. 14 violated when equals treated unequally- SC appeared first on LexForti . Randy Reidwww.itcse.org

Read MoreFederal Holidays & Overtime Pay: How to Calculate Time and a Half

Holidays are usually a time for celebration, reflection, or remembrance, but for small business owners and employees, holiday pay policy can be confusing. Here’s a brief refresher on what’s legal for holiday, overtime, and vacation pay. Need pay and benefits documents for your employees? Put your compensation and time off policies in writing. We make it affordable and simple. Get started now What are federal holidays in the U.S.? Federal holidays are holidays observed by the U.S. government. While a majority of government offices are closed on these days, small business owners and other private employers have the option of staying open. Businesses that close on federal holidays are not required to pay their employees for the day off, and those that stay open are not obligated to pay employees extra for normal work hours. In general, holidays are considered regular workdays and employees receive their normal pay for time worked. If the federal holiday falls on a weekend, it is generally observed on the closest weekday. The U.S. government lists these days as federal holidays: New Year’s DayBirthday of Martin Luther King, Jr.Washington’s Birthday (also known as Presidents Day)Memorial DayJuneteenth National Independence DayIndependence DayLabor DayColumbus Day (or Indigenous Peoples’ Day)Veterans DayThanksgiving DayChristmas Day What are paid holidays? Paid holidays are not required in the United States, however some employers may decide to provide compensation to their employees as a matter of policy, as laid out in an employment contract or employee handbook. In addition to the federal holidays listed above, other paid holidays might also include: Good FridayEasterThe Friday after ThanksgivingChristmas EveThe day after Christmas (also known as Boxing Day)New Year’s EveOther commemorative holidays like César Chávez Day Ultimately, paid holidays are up to each employer to define. If you have questions about documenting your holiday policy, ask a

Read MoreHurricanes and Wildfires: How to Prepare for a Natural Disaster

Wildfires, floods, hurricanes, and tornadoes can cause massive amounts of damage and loss of life. While the disasters themselves can’t be eliminated, there are things you can do to prepare in case a wildfire or hurricane hits close to home. Preparation means preparing your home to avoid damage, taking your insurance documents and contact information with you, and having a solid emergency plan to keep you and your family safe. Here are some tips to help you prepare for specific events. Concerned about storm or wildfire damage? Use RocketEvidence to capture video before and after the fire or storm, and share your question with an attorney. Get started How do I prepare to leave when asked to evacuate during a wildfire? Evacuating your home due to wildfires is never an easy decision. It can be heartbreaking to leave your home behind. But remember that your possessions are insured and monetary things can be replaced. It’s most important that you listen to the evacuation orders when they’re given because they are not given lightly. If you live in an area where wildfires are a major risk, you should make a wildfire emergency plan for your family to follow. This helps you to remain calm and will give you a checklist so that you don’t forget anything important. You should have a supply kit and bags packed and ready to go as part of your emergency plan. You might include irreplaceable things, as well as food and first aid items. There are a number of things you can also do to help protect your home and neighbors during the event. Ready for Wildfire provides an excellent list of essential reminders. How do I prepare to leave when asked to evacuate ahead of a hurricane? Hurricane evacuation is very similar to wildfire evacuation.

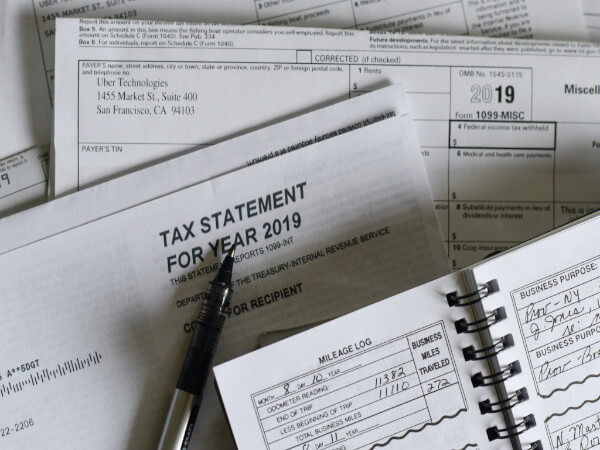

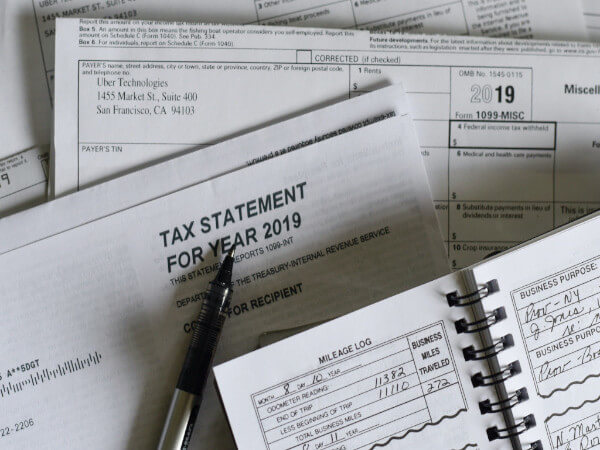

Read MoreDo I Need To Pay Taxes On Private Sales Transactions?

The short answer is “yes.” In most cases, the IRS and your local tax agencies expect tax payments for gains received on larger transactions. While the details of private sales transactions may be difficult for tax agencies to track, legally you are obligated to report your capital gains on items you sell and to pay local taxes on items you purchase. Got a tax question? File confidently with legal advice from Rocket Lawyer On Call® attorneys and tax advice from our partners and friends. Get your answer Tax obligations when you sell a car If you sell a personal vehicle (car, truck, motorcycle, boat or other vehicle for personal use) for a loss, the IRS is generally not interested in the transaction. However, if you sold the car for a profit, you should report that profit as a capital gain. The gain will be classified as either “short term” or “long term,” depending on how long you owned the vehicle. An IRS Schedule D is used to report your capital gains and includes worksheets to help you determine your adjusted cost basis, so you can properly report net gains or losses. If you put a lot of permanent work into improving the vehicle, you may be able to deduct some of those costs from the gain to help reduce your tax obligation. If you sell quite a few vehicles, the IRS may have reason to believe you are in the professional car sales business. Of course, if you are in the car sales business, you’ll want to report your income taxes, capital gains taxes, and business taxes appropriately to avoid issues with the IRS. Tax obligation when you buy a car through a private sale When you purchase a vehicle through a private sale, you must pay the associated local

Read MoreHow To Pay Employees for 4th of July

While we all may agree that the Fourth of July is a joyous time of year, for small business employers, it can also be confusing. After all, the Fourth of July is a federal holiday, and employers and employees often wonder whether holiday pay, time and a half, or maybe even double time pay is required. Below, you’ll learn about how to pay employees on the 4th of July. Need pay and benefits documents for your employees? Put your compensation and time off policies in writing. We make it affordable and simple. Get started now How does holiday pay work for Independence Day? There is no federal law requiring private employers or small businesses to pay employees time and a half on Independence Day, and that’s true for any other holiday. Federal, state, and local government employees are usually provided time off or paid overtime for work on the Fourth of July. So that means how holiday pay works will depend on state labor laws and an employer’s policies. Most businesses only have to provide holiday pay or time off if they have a policy or common practice of paying overtime or providing paid time off on holidays. When it comes to state laws, there are only two states that require holiday pay, and both include Independence Day in their list of holidays: Massachusetts and Rhode Island. For more information about these state’s holiday pay rules, ask a lawyer or visit the labor department website for each state: MassachusettsRhode Island re workers paid time and a half or double time for overtime on the Fourth of July? Outside of government employment, and Massachusetts and Rhode Island, unless an employer has affirmatively agreed to pay overtime or double time for all hours worked on holidays, then this is entirely up to

Read More